API is the technology that represents the future of the banking industry. Though apis have been extensively used in the business world for more than twenty years, it is presently turning out to be more prevalent in banking, as financial institutions implement more advanced and contemporary technology solutions. In case you want to stay ahead in the market, you must understand how apis work and how they are profoundly impacting the overall industry. After all, api for banking is a must in the present time.

Basics about api

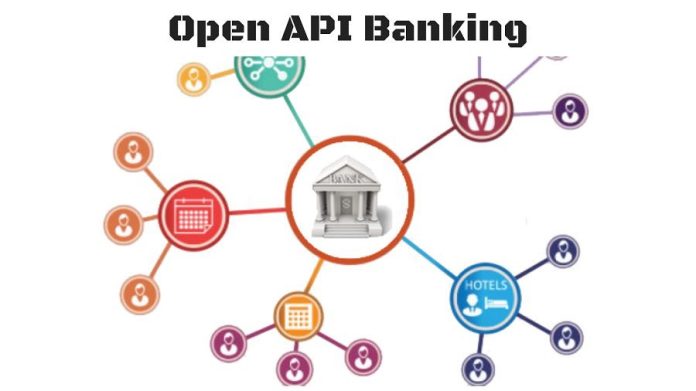

An API, even known as application programming interface¸ is a group of tools and protocols that get used to build software and applications. In the realm of banking, apis permit programming experts to simply create applications that aid the financial institutions in exchanging data with third-party financial technology organizations.

Now, apis in the realm of banking industry give financial institutions the capability to connect with businesses and even consumers, transfer information at a more convenient and effective pace, and expand the number as well as breadth of services they can offer. Given the success of apis throughout the globe, it might have a huge variety of implications on the future of the overall banking market.

It would not be wrong to state that API technology represents the future of the overall banking industry. While apis have been extensively used in the business world for more than twenty years, it is presently becoming more prevalent in banking, as financial institutions implement more contemporary technology solutions. If you want to stay ahead in the overall market, you require to understand how apis work and how they are actually impacting the overall industry.

The working of api in banking

Apis are somewhat relevant to several essential banking functions as well as services. One of the most critical is that it permits the banks to make their services accessible to third-party companies offering diverse other services. The API sets communication parameters and even permits verified sources to interact with the bank’s information. Now, a company can easily connect directly with a bank once a common customer purchases the company’s product or even service. The same is worth for investment apps, money transfer apps, and even any sort of other that accesses a user’s bank information.

Why apis matter so much?

API technology has made a great sized difference in the way businesses operate. As a main resource for fostering innovation, apis give companies more freedom than even ever before to form up new products, provide fresh services, and improve their overall reputation inside their industry. Some sources showcase that most businesses with integrated high-degree API technology feel they are more successful than simple businesses that use just the basic or no apis.

More financial institutions have lately started experimenting with API banking possibilities. This is fore the reason of the potential they have to transform the overall industry and boost the experiences of bankers and customers over a long-term foundation. In case banks continue moving toward this kind of technology, the industry will definitely start to see changes in the way data gets handled, and the way services get integrated. This might even increase cost-effectiveness as well as efficiency for banks all around. It is clear that the importance of apis is quite huge.

Apis are preparing banks for the times to come

The power of apis to give fresh sets of ways of communicating with suppliers, consumers, transactions, even and data is game-changing. Financial firms that do not really invest in apis now will fall behind their overall competitors. You currently live in an API society having the banks only recently joining in. Despite the reality that API technology is not new, customer growth, overall market disruption, and regulatory change showcase that the banking industry is simply anticipating and planning for an API revolution.

Quick Access to customer data

Of course, most of the banks in the present time enable third-party platforms to access data and even execute banking operations because they have restricted and secure access to their overall core banking system. Transactions, account information verification, all the balance enquiries, and other actions fall within such a category. Apis make the bank a lot more appealing to customers by permitting them to engage with financial data in more sophisticated manners. By boosting the overall brand loyalty and adhesiveness, it may actually improve customer engagement and even satisfaction.

Growing the customer experience and engagement

Apis can be really employed to improve overall customer engagement and even respond to customer requests in a secure, absolutely agile, and future-proof manner. Historically, the conventional type of banking industry has been somewhat slow to adopt new technologies. By introducing apis to financial services startups, conventional types of banks can easily retain existing customers by offering innovative services. Further allowing the banks to appeal to potential clients seeking high-tech level of services.

Reduce overall expenses

Banks having the open apis can also evade developing costly in-house technological platforms by simply effectively outsourcing the work to experienced and even cost-effective fintech firms. Of course, if you want that, you can do it for sure.

Moreover, you know what apis play a crucial role in Open Banking projects that must not be overlooked. In the new Open type of Banking ecosystem, apis are a business channel. API adoption and even utilisation can help banks expand as well as improve their services and offerings. These apis, on the other hand, have the overall potential to alter the banking industry by permitting the fintech companies to make use of the data to improve their products.

New Opportunities for banks

For one, API banking opens wide spread opportunities for new clients to simply access a bank’s services. For clients that live simply far from a bank, making the trip to the brick-and-mortar location could actually be out of the question. The internet remove the overall distance as a barrier keeping new clients from joining any bank, and apis facilitate a seamless type of online banking experience. Now, an unused market of clients can access your overall bank’s services.

Apis even help banks for connections with the businesses that are most successfully employing overall fintech’s. Solid relationships with online retailers, money transfer app developers, even investment apps, and similar companies may help any sort of bank secure customers and even boost transaction fee revenue.

Conclusion

To sum up, since you know much about open banking api and how you can integrate it in your banking expedition; you should not miss out on it.